How Credit Repair Helps Consumers Build a Stronger Financial Future

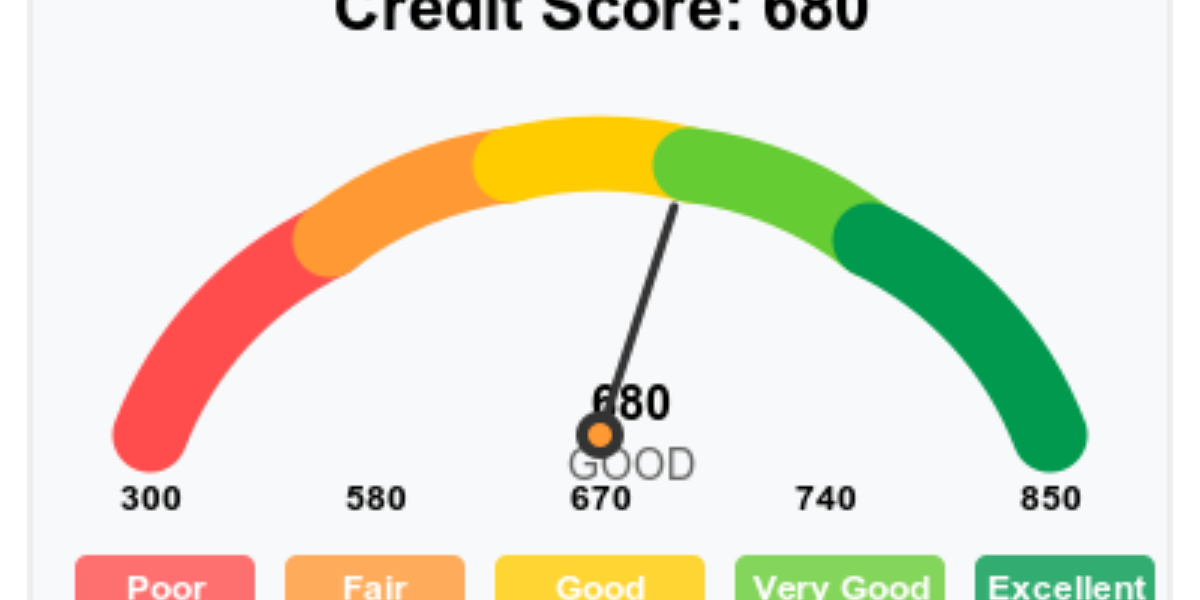

In today’s economy, a strong credit score is one of the most powerful financial tools you can have. From qualifying for a mortgage to securing lower interest rates on loans and credit cards, your credit report influences countless financial decisions. Yet many people struggle with low scores caused by errors, outdated information, or past financial challenges. This is where credit repair becomes a transformative solution.

Credit repair focuses on reviewing your credit reports, identifying mistakes, and disputing inaccurate entries to ensure your report reflects your true financial history. As credit awareness grows, so does the popularity of related opportunities, especially for marketers who use a credit repair affiliate program to share resources and earn commissions.

Why Credit Repair Matters More Than Ever

Millions of consumers are affected by credit reporting errors each year. These mistakes may include incorrect balances, old negative accounts, or fraudulent activity, all of which can cause serious damage to a credit score. Because lenders rely heavily on credit reports, even one small error can lead to loan denials or higher borrowing costs.

Credit repair helps fix these issues by:

-

Removing errors that lower scores

-

Challenging unverifiable negative items

-

Educating consumers on how credit scoring works

-

Encouraging better long-term financial habits

As more people recognize the importance of protecting their credit health, the demand for credit repair services continues to increase.

Professional Credit Repair: Why Many People Choose Experts

Although individuals can dispute errors on their own, many prefer working with professional credit repair companies. These experts understand consumer protection laws, communicate directly with lenders and credit bureaus, and build a personalized plan to help clients restore their credit.

A typical professional credit repair process includes:

-

A full review of reports from all three credit bureaus

-

Identification of questionable or inaccurate items

-

Drafting targeted dispute letters

-

Regular follow-ups with bureaus and creditors

-

Personalized guidance for building positive credit

This structured approach speeds up the dispute process while giving consumers clarity and confidence.

How Credit Repair Creates Long-Term Financial Strength

Credit repair is not just about fixing mistakes—it’s about creating new opportunities. Once inaccurate negative items are removed, consumers often see improved credit scores, which may lead to:

-

Lower interest rates

-

Higher approval chances

-

Better insurance premiums

-

More negotiation power

Beyond disputes, credit repair encourages healthy habits like timely payments, responsible credit use, and maintaining a balanced credit mix. These habits build lasting financial stability.

As this industry grows, so do related opportunities for bloggers, influencers, and educators—especially through a credit repair affiliate program, which allows them to connect consumers with trustworthy services while earning commissions.

A Growing Industry With Expanding Awareness

The internet has made credit education more accessible than ever. Financial blogs, social media creators, and online communities regularly share insights about credit scores and credit repair strategies. This rising awareness fuels the credit repair industry’s growth—and strengthens the appeal of joining a credit repair affiliate program as a secondary income stream.

Final Thoughts

Credit repair has become an essential service for anyone seeking financial progress and peace of mind. By correcting errors, improving credit behaviors, and providing expert guidance, credit repair empowers consumers to build a stronger and more stable future. As the industry continues to grow, opportunities like the credit repair affiliate program offer consumers and marketers alike a valuable new pathway to financial improvement.